Spatial Computing: The Inflection Point for VR & Immersive?

Past cycles

The boom-and-bust cycles of immersive tech have exhausted many of us for over a decade and, quite understandably, resulted in a whole bunch of trust issues. Whether it was the promise of the first Oculus Headsets, the release of wholly standalone devices, or the emergence of capable mixed reality and spatial computing hardware, we've been on a rollercoaster. The limited user base and the relegation of applications to niche corners have so far stifled the industry's growth potential. Until - maybe - now.

Something has changed to prompt giants like Apple and Google to enter the market.

What is that? - What’s different this time? - Have we graduated from boom-and-bust cycles to a smoother upward trajectory for the industry?

What has changed?

The bigger little numbers behind one big number that explains ‘why now?’

One change that prompted Apple and Google to enter the market and Meta to accelerate their focus on mixed reality is quite predictable. Advances in technology, particularly in computer vision and the ORB-SLAM system.

We can take a chronological view using just ORB-SLAM alone, a computer vision system that can triangulate a position in space using camera and sensor data. Its evolution through three generations (with the most significant years being 2016, 2018, and 2020) has seriously enhanced the system's capacity to interpret and interact with the physical world. The 2016 V1 led to the creation of ARCore and ARKit (Google’s and Apple’s respective phone-based augmented reality software); the 2018 V2 is credited with enabling the standalone marvel that is the Oculus Quest; and the 2020 V3 provided the foundation for the Apple Vision Pro and Meta Quest 3.

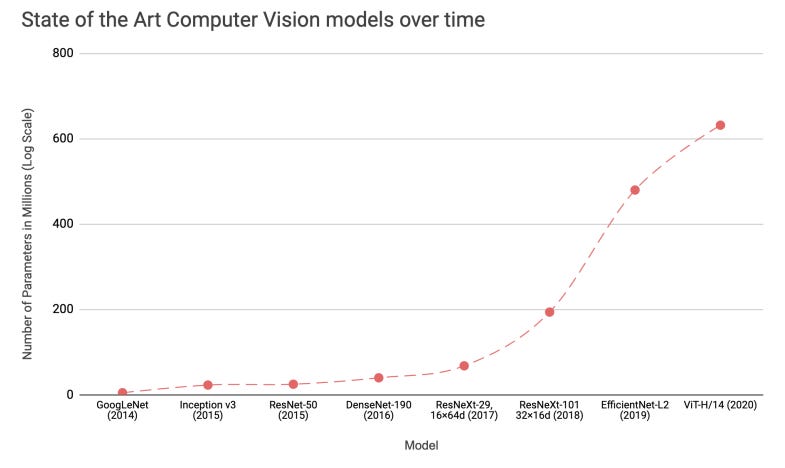

However, it is not just one system that fostered such an eager revival of the industry, but multiple technological enhancements reinforcing each other. Beyond the predictable increased computational power of mobile chips and the incredible resolution of the AVP screens ($400 a pop for the pleasure), what is producing such stable and convincing experiences is the advancement and weight of computer vision deep learning algorithms. (see title image) The combination of computer vision and ORB-SLAM ensures that 3D apps and assets sit perfectly anchored in space as you use the devices and no longer jitter about. The enormous advances achieved in 2018/19/20 – which, in sync with other deep learning algorithms, meant that systems could run in an increasingly streamlined way - translated 5 years later into a system that can run constantly on the mobile computational power of the AVP and Quest 3.

To get a feel for how that combination is working, see this recent video by Meta, outlining how their latest spatial reconstruction uses computer vision to structure your virtual environment:

Technology advances have been driven by but also provided the foundations for major investments in spatial computing market, marked most clearly by the addition of Google and Apple seriously entering the market.

What’s different this time? One Big Number

The difference this time, however, goes beyond technology and beyond too the addition of Apple or Google to the market. However impressive, Meta has demonstrated that ‘will + resources’ does not a market create. Instead, it is the second-order effects that have led to a new wave of excitement.

The number of developers who had launched Mixed Reality & VR/AR Apps –

Dec 2023:

2,400

The number of developers now able to launch Mixed Reality & Spatial Computing Apps –

Feb 2024:

30,000,000 +

The transformative change in the spatial computing landscape is epitomised by the meteoric rise in the number of developers—from a few thousand focused on gaming to millions of mobile developers. Apple not only launched a piece of impressive hardware but gave its tens of millions of mobile developers the tools to bring their apps, content, and intellectual property into 3D so escaping the constraints of traditional screens. Though it’s difficult to quantify exactly what outcomes will come from more creators and developers working in this medium, good test for the success of the platform will be how willing these developers are to release for AVP.

What we do know is that this now huge community of developers needs a whole host of tools that are designed for 3D rather than 2D to support them in creation, experience, reach, and monetization.

What signs show the industry has moved from boom-bust cycles to steady growth?

We now need to see how developers entering the XR space, with their own content and IP, create applications that drive adoption—and equally as importantly, what prompt people to want to put on hardware at some point every day. Though it’s impossible to say what the killer app category will be, what I feel is clear is that it will tap into a core human attribute above all - a desire for empowerment and autonomy over our physical and digital lives. As I’ve written before, the use cases that get me most excited in MR & Spatial are those that increase our autonomy over aspects of our digital lives.

While we wait on data for this growth, we can track the boom in the enabling technologies. Apple’s entrance provided the fundamentals for spatial development and made (almost) all iOS apps accessible in Spatial Computing. However, as with Mobile/Gaming before, a bunch of developer tools have jumped up to support developers and content creation. The excitement and adoption they have garnered provides some encouraging forward-looking indicators. Notable examples include – Bezi & Spline (both positioning as the Figma and Canva of Spatial 3D, $15M & $13M raised) – Echo3D ($10M raised for 3D asset management & creation) – and most recently Graswald (raising $3.3M for Ai driven 3D content creation). Along with growing amount of support from established players like Unity, Figma, Adobe & Blender.

In the meantime, the industry is set to experience encouraging further bumps in interest over the next 12 months—most prized among these being Google & Samsung’s entry to the spatial computing market. Positive bumps like this, combined with increasingly exciting apps coming to market, represent a case for a new steadily accelerating upward trajectory for the industry. I think we can expect a near term future where regular new releases become almost routine, but one which frees us from the regularized troughs of disillusionment experienced since 2014.

To Wrap

It’s clear the die is cast—the hardware is as convincing as it’s ever been, and on an increasingly clear road to light additive augmented reality (an experience akin to the convenience of a pair of sunglasses)—and the developer community simply can’t get meaningfully larger.

This isn’t to say it’s all plain sailing from here—unlike some other industries, like wearables, for example—the investment demanded by consumers to engage with MR & Spatial Computing is large, not just financially but in terms of the force of will each time they choose to use the device. This means that simply marginal improvements to our lives— akin to tracking one’s heart rate or sleep patterns with an Apple Watch —are not sufficient to ensure long-term success.

It is the millions of new developers with the tools to enter the space which will now determine whether MR & Spatial Computing becomes part of our everyday lives. These same developers need a whole host of technologies to work for them in MR & Spatial in a way they do so stably in 2D or mobile in terms of delivery, creation - and, above all, monetisation.

My latest post capturing my (measured) excitement for the worlds of spatial computing and mixed reality. For complete transparency, I, along with some incredibly talented industry veterans, have started a new venture building foundational technology for this future of Spatial Computing & Mixed Reality.

Subscribe to read more…I always love a good debate on LinkedIn too!